Leaving New Zealand Filing Tax Return

Working holiday makers, if you are leaving New Zealand and not receiving income anymore, you may need to complete an Individual income tax return (IR3) declaring your income and expenses up to your date of departure.

How To File Tax Return

There are 2 ways in getting your tax return.

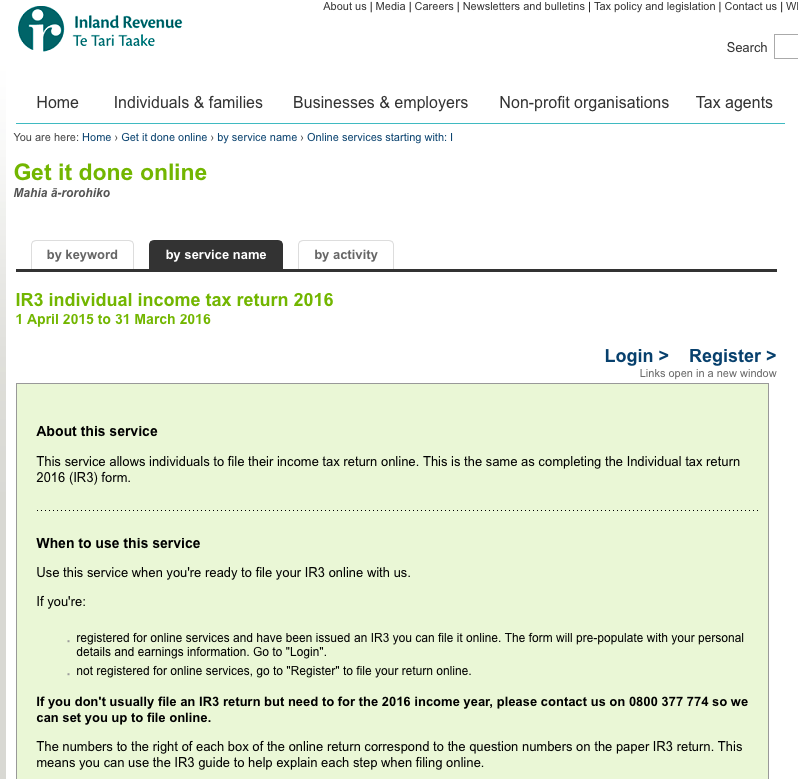

- IRD Tax Return Link – Wait till the end of the tax year (31st March), and log into myIR(IRD online account), click on the link and follow the step by step guide.

- Send in IR3 form to IRD office – Do it on the day you are about (a week before) to leave New Zealand. Download the IR3 form, fill it up and submit to Inland Revenue office or via post (P O Box 39090 Wellington Mail Centre Lower Hutt 5045).

Needed Documents

Together with your IR3, you need to prepare:

- Proof of your income, deductions and claimable expenses information until the date of your departure.

- Airline tickets or a travel agent’s itinerary with proof of full payment.

- Updated postal address, including country and postcode.

IRD Return Tips

- Send tax return inquiries through the myIR secured mail.

- Remain your New Zealand bank account active to get your tax return directly credited into it.(Fastest and safest)

- Nominate someone to help you out, you need to provide his/her name and IRD number to IRD.

- Do it online.