New Zealand Working Holiday Tax Code

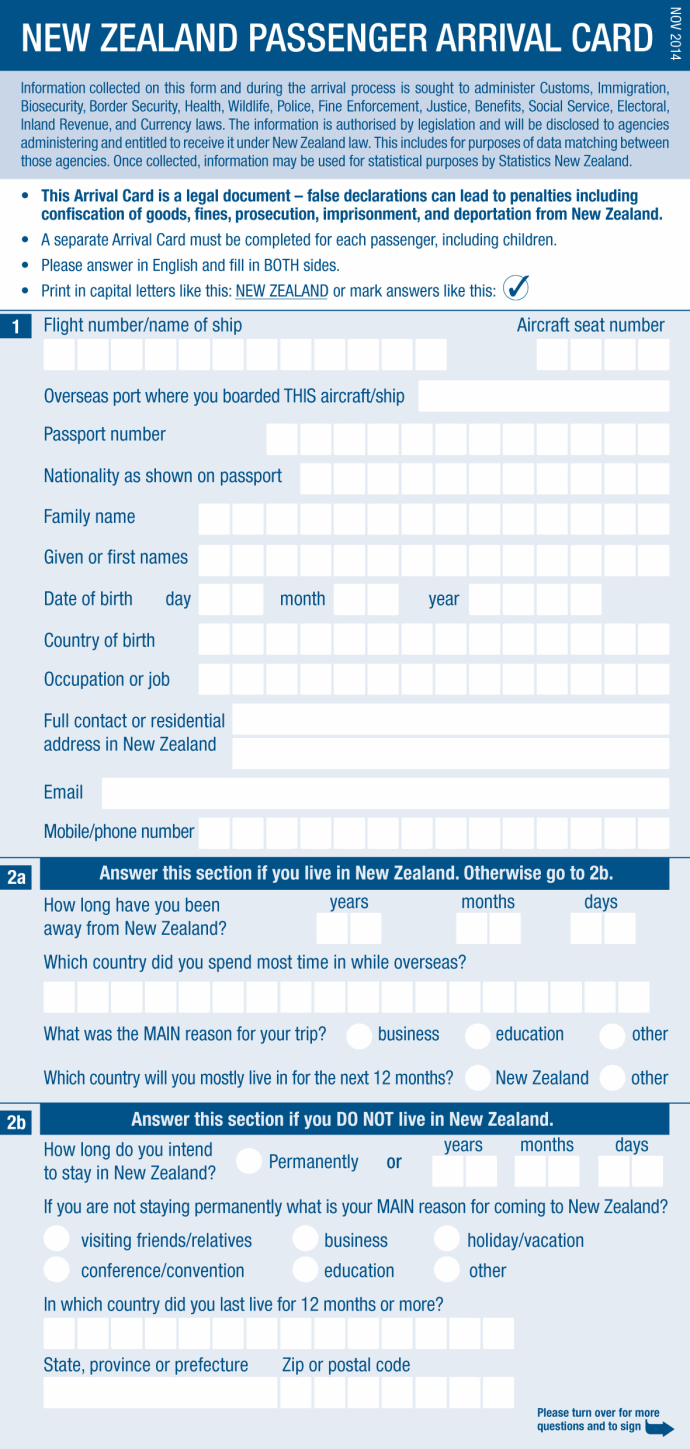

Usually on the first day of your work, you will be required to fill up your tax code and IRD details.

New Zealand Working Holiday Tax Code

- M for person who has only one job, and that job is the primary job.

- WT for schedular payments.

- CAE for the earnings of casual agricultural employees.

- NSW for the earnings of non-resident seasonal workers.

- STC for a special tax code. This is a tax rate worked out to suit your employee’s individual circumstances. It usually applies when using one of the standard tax codes will result in too much or not enough tax being deducted.

- S for second job with a lower income.

New Zealand Working Holiday Tax Code

Which tax code a working holiday maker should choose? Working holiday makers can use either tax code M or CAE.

Which tax reduction is lower? CAE tax rate is lower than M. CAE tax deduction is depending on your earnings. If you earn less than NZD 14,000, you will be waived from paying tax. However, if you earn more than NZD 14,000, then you have to pay tax.

However, most of the working holiday makers don’t know how much they are going to earn in a year, therefore M is the better option.

What if I have a second job, what tax code should I write? Your tax code for the second job is S.

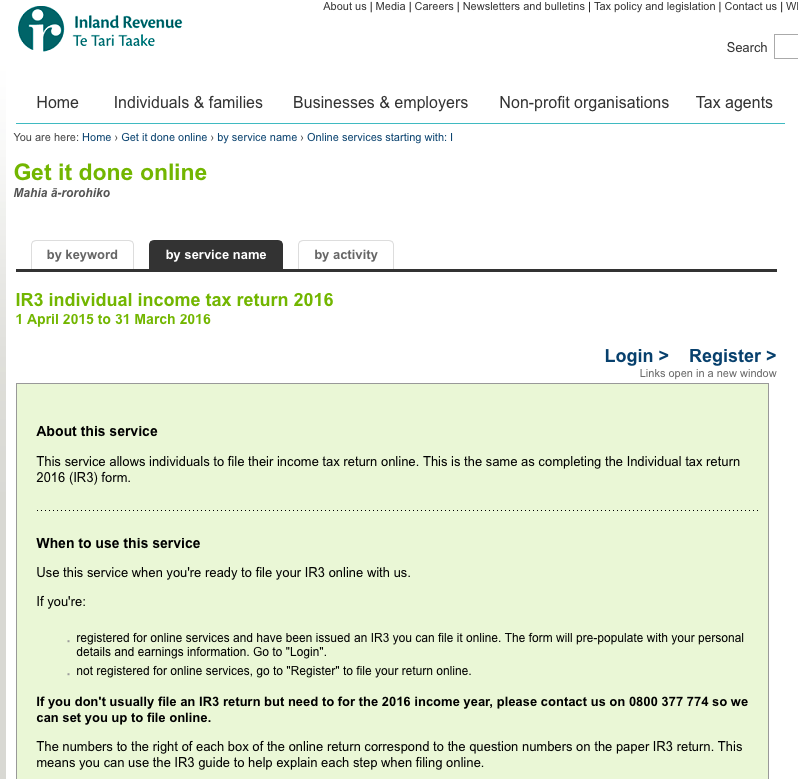

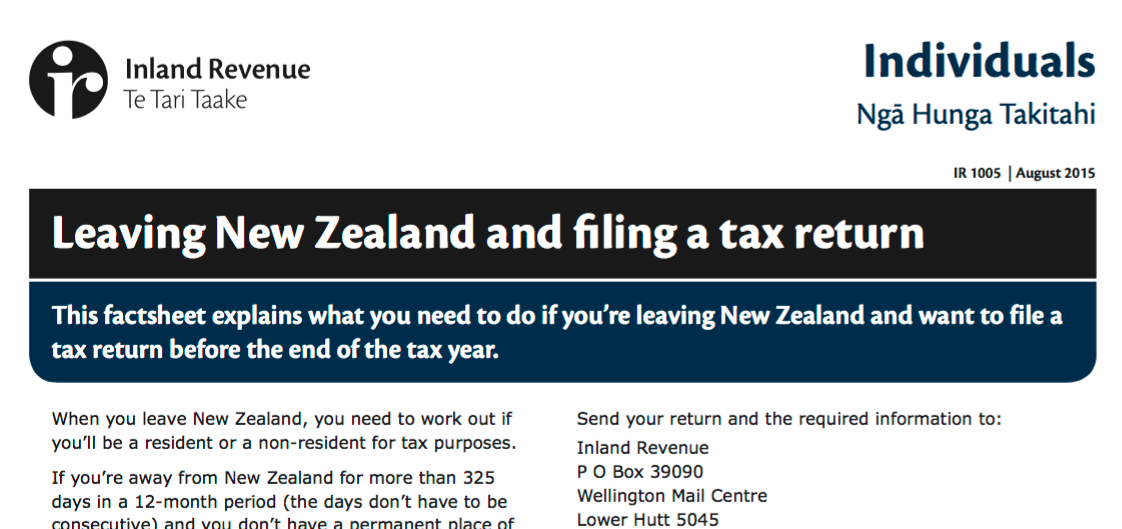

Tax Return

What If I pay more than I suppose to? Don’t worry, that’s where the tax return kicks in. Working holiday makers can apply a tax return after they are done with their working holiday. All the extras, will bank in back to their New Zealand account or a cheque will post to their correspondence address.